How to increase the effectiveness of debt collection thanks to the contact center platform?

According to the survey among micro, small and medium enterprises conducted in the third quarter of 2019*, half of the companies informs that in the last 6 months they have been waiting for the collection of payments from contractors more than 60 days after the deadline.

Effective debt collection in a company is, apart from marketing, sales and customer service, a very important process in the organization, which affects the financial liquidity required for its efficient functioning.

Therefore, effective debt collection is a lifelong dream for many companies. The debt collector quickly contacts the client and during the conversation the debtor settles the outstanding amount. That would be the ideal situation. However, in practice it rarely looks like that. Debt collectors have big problems to reach the debtors, they spend a lot of time “tracking” the contact to make a call and the conversations often end up in an unpleasant atmosphere.

What does effective debt collection depend on? In our opinion, a good contact center system, which supports consultants in negotiations with debtors, is crucial. See how contact center tools can increase the effectiveness of debt collection and reduce its costs.

How to effectively reach the debtor?

The basic prerequisite for successful debt collection is, of course, availability. However, late paying contractors often do everything they can to avoid answering the call from the debt collection department. They change phone numbers or blacklist the consultant’s number.

How to increase the reachability with the debtor with contact center tools?

One of the most interesting functions in this area is the random outgoing calls numbering. Each time a different GSM number is presented to the recipient. Consultants using the rotating number database have a much higher contact rate. The debtor cannot remember the numbers associated with the debt collection department and usually receives the call in the end.

Another functionality that makes the effective debt collection possible is a telephone, SMS and e-mail campaign. Mass sending of reminders related to overdue payment will not only increase the scope of debt collection, but will also optimize the work of the consultant. Automation of communication also lowers the cost of the debt collection procedures.

How to save time of your consultants?

Optimization of the work of the debt collection department is influenced not only by automatic telephone campaigns. It is worth eliminating in advance those phone numbers that the consultant will definitely not reach. The HLR function is used for this. It detects inactive or wrong phone numbers. If we want to ensure that a consultant is only routed to effective connections, we can use AMD function. It allows you to detect calls directed to voice mail or fax.

Call queuing and automatic task distribution are another functionalities that optimize the work of the debt collection department. Effective debt collection is an orderly activity, which is carried out by appropriate consultants. If a debt collection software improves the prioritisation of tasks, this affects the speed of the debt collection campaigns.

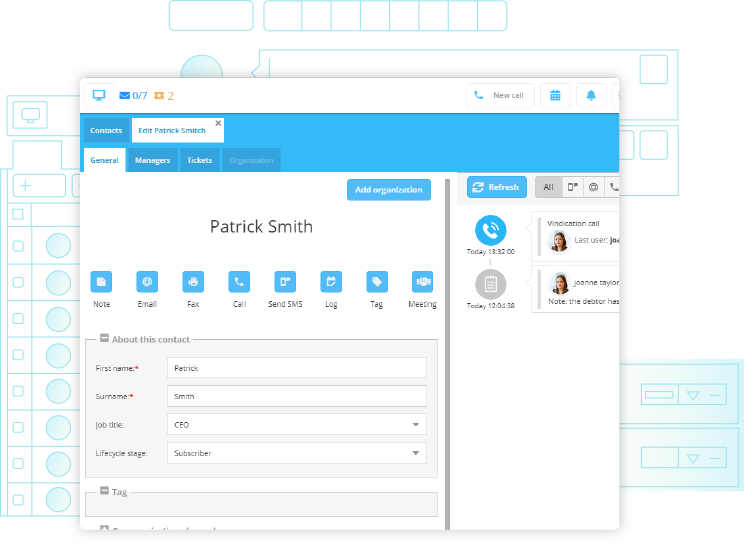

In order to achieve the effectiveness of debt collection, the consultant should have free access to data about the debtor also from persons outside the debt collection department, e.g. from the sales or marketing department conversations. Therefore, the CRM system integrated with the contact center makes it much easier to recover the debt. The consultant will find there the whole history of contact with the client as well as recordings and scripts of conversations conducted with him/her.

How to improve debt collection negotiations?

The automatic referral of tasks to the guardians serving the debtor will also help to settle the matter quickly. Personal relationships and arrangements significantly increase the likelihood of debt recovery.

At the same time, unified communications and unified messaging allow all communication channels to be integrated. The consultant, while conducting the debt collection, knows how the conversations with the client have gone so far, regardless of the channel the debtor has contacted so far.

The debt recovery process sometimes also requires the organization of multilateral, multimedia conferences. They can be easily carried out by adding more people to an ongoing conversation (AdHoc) or by using pre-created conference rooms (MeetMe). Invitations to conversations in the form of http links (Invitation Link) allow you to join a conversation from any device connected to the Internet. Thanks to this, all persons who can improve the course of the debt collection process participate in the conversation.

How to make it easier for a debtor to return a debt?

Integration with payment systems is a very useful feature. With the appropriate API, you can connect the contact center platform with payments, so that the debtor can pay the amount due already during the conversation.

It is also worth making it as easy as possible for the debtor to contact the debt collection department. If the debtor is unable to reach the consultant, the call-back service will ensure that the consultant does not lose the chance to talk to the debtor.

If, on the other hand, the debtor contacts the debt collection department again, we should ensure contact with an advisor who will provide fast and professional service. With the IVR and ACD services, he/she will be referred directly to the appropriate team or guardian who is in charge of his/her case.

Nowadays, a smartphone or tablet should be enough to confront the debt collection department. Therefore, the contact center system equipped with a widget on the website and an application for mobile devices supports successful debt collection.

How to prepare consultants for effective debt collection?

The debt collection system can also support debt collection by systematic monitoring of the quality of debt service. Performance indicators and historical data allow for the development of effective debt collection campaigns. Easy generation of easy-to-read reports helps to maintain high quality communication during the debt recovery process.

An important source of knowledge about debt collection conversations are automated client survey tools – voice or e-mail surveys filled in by recipients. When servicing a client, it is worth paying attention to his/her satisfaction not only during business or helpline talks. The quality of debt collection operations can also help build a positive client experience.

Improving the effectiveness of negotiations with a debtor is also connected with conversation templates and scripts on the basis of which it is possible to conduct trainings for employees of the debt collection department. This is particularly important in the case of demanding negotiations and “difficult clients”. The consultants, having prepared conversation scripts, can implement high standards of customer service also in terms of effective debt collection.

It is not without significance that new employees can be deployed quickly. You can also use the active assistance of the instructor by adding him/her to ongoing conversations in eavesdropping or prompting mode. Quick and easy improvement of skills is achieved thanks to a well-built knowledge base.

How to prepare consultants for effective debt collection?

A modern contact center system can significantly facilitate debt collection operations. Therefore, if you want to choose a contact center platform for your company or expand an existing one, check if it has features that support effective debt collection:

- Does the contact center system increase the contact rate?

- Does it have tools to automate consultants’ work?

- Does the contact center support omnichannel communication?

- Does it organize the distribution of calls of debt collection department employees?

- Does it provide easy access to client connection history?

- Does it allow for the inclusion of other departments within the company in the debt collection process?

- Does the contact center platform integrate with payment systems?

- Does it allow to monitor the quality of debt collection communication?

- Does it support the system of trainings for employees of the debt collection department?

The Conpeek client communication platform is a comprehensive solution that will improve communication with clients also in the area of debt collection. See how the Conpeek debt collection software works. Make an appointment and we will provide you with a demo version of our client communication platform.

* “SME survey, among micro, small and medium enterprises” study [Skaner MSP, wśród mikro, małych i średnich firm] conducted by the Keralla Research Institute for B2B Solutions and Research [Instytut Badań i Rozwiązań B2B Keralla Research], on a sample of 500 companies selling on deferred payment terms by telephone interview technique, July 2019.